Global Automotive Market Overview – 2024

Jul 26,2025

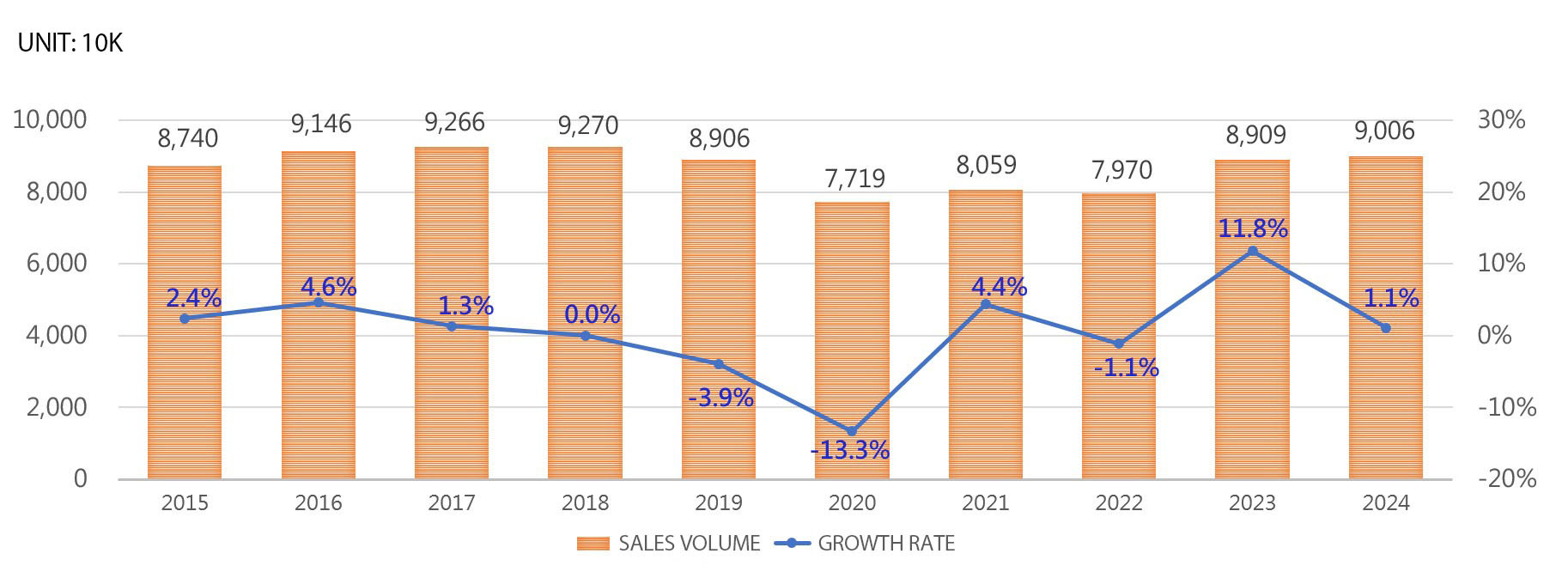

In 2024, global vehicle sales reached a total of 90.06 million units, representing a modest growth of 1.1% year-on-year. Although high interest rate policies and slower economic growth in some countries have tempered the market’s momentum compared to 2023, the overall performance still marked the highest sales volume since the onset of the COVID-19 pandemic in 2019 (see Figure 1).

The following section reviews the market dynamics of key automotive markets around the world in 2024.

Figure 1. Global Vehicle Sales and Growth Rate Trends

Mainland China Increases Subsidies for Vehicle Replacement, Driving Domestic Brands’ Market Share to Record Highs

Mainland China remained the world’s largest automobile market for the 15th consecutive year, with total vehicle sales reaching 25.58 million units in 2024, a 1.1% increase (see Figure 2). Supported by the continued implementation of the “Automotive Industry Growth Stabilization Plan (2023–2024)” and the second round of the “Old-for-New Vehicle Subsidy Guidelines” introduced in August 2024, existing vehicle replacement subsidies were raised from RMB 7,000–10,000 to RMB 15,000–20,000. This effectively stimulated market demand and further revitalized overall vehicle sales.

Domestic brands such as BYD, Geely, Chery, Changan, Great Wall, and SAIC performed strongly, collectively capturing over 60% market share—a historic high. In contrast, joint venture brands are facing increased operational pressure in the Chinese market.

Figure 2. Overview of Vehicle Sales in Major Global Markets in 2024

Second and Third Largest Markets: The U.S. and India Maintain Post-Pandemic High Sales

The United States ranked second in global vehicle sales in 2024, with a total of 16.46 million units sold, marking a 2.1% increase and reaching a new post-pandemic high. This growth was driven by new model launches, intensified promotional efforts by dealers, and increased consumer confidence following the pandemic. Additionally, after former President Trump’s election in 2024, the announcement of various automotive policies—such as increased import tariffs on vehicles and the removal of EV subsidies—created market expectations of higher future vehicle prices. This prompted some consumers to accelerate their purchases, resulting in a wave of “demand brought forward.”

India secured the third position with 5.23 million vehicles sold, a 2.9% year-on-year increase. Despite economic growth falling short of official forecasts and a weak commercial vehicle market (950,000 units sold in 2024, down 2.7%), strong demand in the SUV segment (2.11 million units, up 15.9%) supported overall market growth. Major manufacturers such as Maruti Suzuki and Tata Group achieved their highest sales in nearly five years.

Japan Emerges from Type Approval Crisis, While Mexico Faces Tariff Barriers

Japan, a traditional automotive powerhouse, saw vehicle sales of 4.42 million units in 2024, representing a 7.5% decline and marking the fifth drop in six years. This downturn was primarily due to compliance issues with type approval certifications involving manufacturers such as Toyota, Honda, Mazda, and Suzuki. As a result, Japan’s Ministry of Land, Infrastructure, Transport and Tourism (MLIT) ordered a suspension of production for non-compliant models until they passed re-inspections for safety and environmental standards. This scandal affected over five million vehicles produced and sold in Japan, making it the most severe in the country’s history. Fortunately, from July 2024 onward, affected manufacturers have gradually resolved the issues and resumed production, minimizing the impact and allowing the market to return to normal.

On the other hand, Mexico, frequently cited by the Trump administration, recorded sales of 1.56 million units in 2024, growing 9.8%. Since the U.S.-China trade war, Mexico has attracted automaker investments due to its cost-effective labor and “nearshoring” policies. Localized, affordable models such as the Chevrolet Aveo (priced at 295,000 pesos, approximately TWD 468,000) and the Solarever Electric Vehicles E-WAN Cross Lite (priced at 279,000 pesos, approx. TWD 443,000) have further fueled market growth.

In Europe, the five largest markets showed mixed results: Germany nearly flat at 3.14 million units; the UK up 2.8% to 2.31 million; France down 2.4% to 2.11 million; Italy down slightly by 0.3% to 1.76 million; and Spain growing 8.1% to 1.20 million units.

Conclusion

The growth momentum of the global automotive market in 2024 has slowed compared to 2023. How governments around the world will further stimulate their domestic auto markets will be a key focus of future policy decisions. Additionally, former U.S. President Trump officially imposed a 25% tariff on imported vehicles starting April 3, 2025. From May 3 onward, a 25% tariff will also be applied to 130 automotive component HTS codes, including engines, transmissions, and automotive electronics. Industry research firm GlobalData forecasts that these measures will have a notable adverse impact on the global auto market, potentially causing a decline of more than 6.6% in the U.S. market alone. Automakers have accordingly developed production cuts and workforce reduction plans—for example, Stellantis plans to lay off 900 employees—in hopes of navigating through this challenging trade environment.

Contact Us