The Japanese Automotive Industry: Transitioning from Export-Focused to Global Integration

Jul 30,2025

The Japanese automotive industry has long held a significant position in the global car market. As one of the world’s leading automobile manufacturers and exporters, Japan’s automotive sector plays a crucial role not only in its domestic economy but also exerts considerable influence on international markets.

This article provides an in-depth analysis of Japan’s automotive industry’s export history, current status, and future trends, focusing on its transition toward greater global integration.

Current Overview of the Japanese Automotive Industry

The rise of Japan’s automotive industry began in the post-World War II era. With the country’s economy in urgent need of reconstruction, the automotive sector emerged as a critical driver of economic recovery.

By the 1950s, Japan had entered large-scale vehicle production and gradually expanded its presence in international markets through exports. In the 1960s, Japanese automakers significantly enhanced their competitiveness by adopting modern manufacturing technologies and implementing rigorous quality control systems.

By the late 1960s, Japan’s automotive exports began to grow rapidly. Brands such as Toyota, Honda, and Nissan gradually established a strong foothold in North American and European markets. During the 1970s, the global oil crisis triggered a surge in demand for fuel-efficient vehicles—an area where Japanese cars stood out for their superior fuel economy and reliability, earning widespread consumer trust.

In the decades that followed, Japanese automakers continued to expand their global market share and established production facilities in various countries. This marked a significant transition from an export-driven model to a globally integrated production strategy.

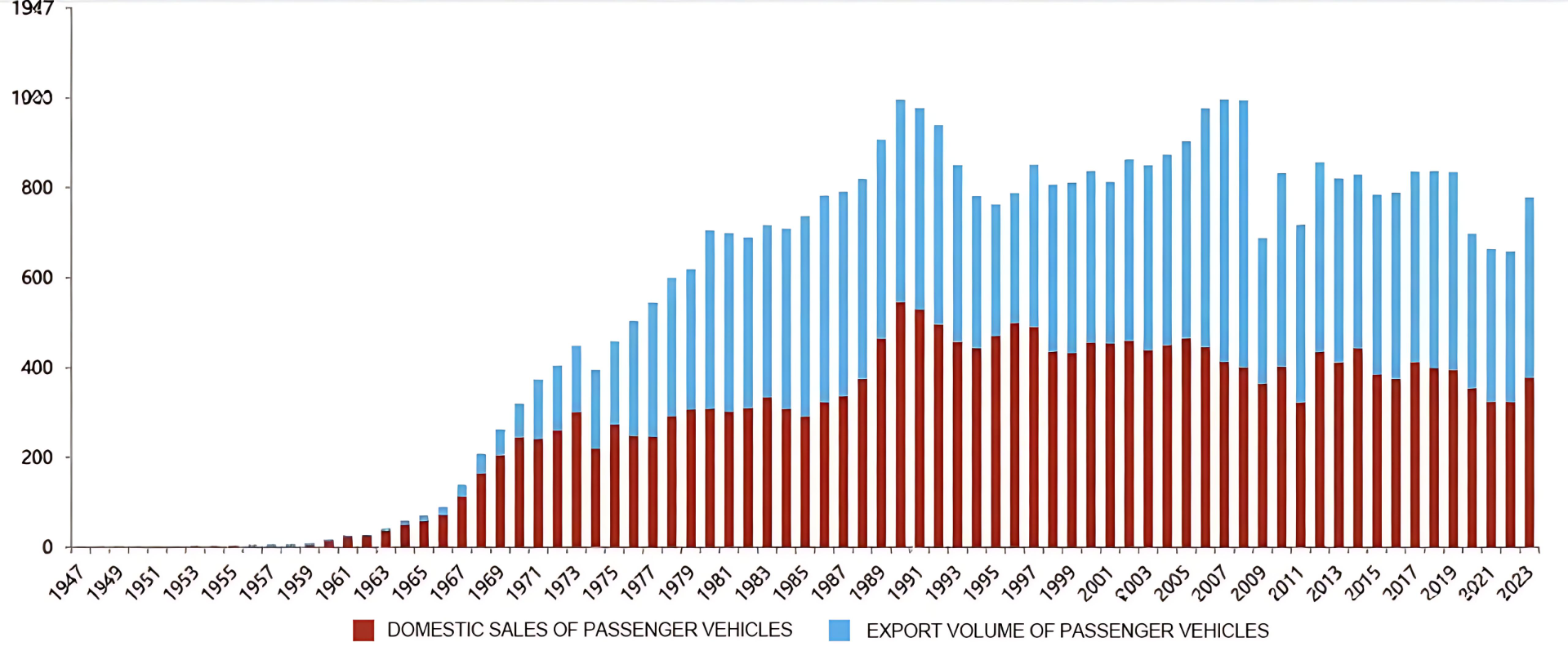

- 1970–1980: Export-Driven Phase During the oil crisis, Japanese automakers saw a dramatic surge in exports—from 1 million to 4.5 million units. This period solidified Japan’s reputation for producing vehicles that offered strong performance, excellent fuel economy, and efficient mass production, establishing a robust export-oriented product system.

- 1980–2000: Overseas Manufacturing Phase Driven by localized production strategies, export volumes increased from 4.5 million to 10 million units. From the 1980s onward, Japanese automakers rapidly expanded their overseas footprint, particularly in the U.S. and other global markets. Overseas manufacturing became the primary mode of global sales—a model that continues to this day.

- 2000–2018: Growth Fueled by Key Single Markets The rapid development of markets in Asia—particularly China—propelled Japanese automakers’ regional production and sales from 10 million to 25 million units. This surge further reinforced Japan’s global automotive influence.

As of 2023, Japan remains a major player in the global automotive industry. According to the Japan Automobile Manufacturers Association (JAMA), in 2022, Japan’s automobile exports reached nearly 6 million units—accounting for over 60% of its total vehicle production.

North America, Europe, and other parts of Asia remain the primary export markets for Japanese automobiles. In particular, Japanese brands have maintained a strong market share in North America for decades, thanks to their high quality, competitive pricing, and reliable after-sales service.

To further integrate into global markets, Japanese automakers have accelerated their overseas manufacturing strategies in recent years. Leading brands such as Toyota, Honda, and Nissan have established multiple production facilities in countries including the United States, Canada, Mexico, the United Kingdom, France, China, and Thailand.

This global production footprint not only reduces export tariffs and logistics costs but also allows manufacturers to respond more flexibly to changes in local market demand. For example, Toyota’s manufacturing facilities in the U.S. not only supply the North American market but also export vehicles to South America and other regions.

Japan’s global competitiveness in the automotive industry is also strongly reflected in its commitment to technological innovation. Japanese automakers lead the field in hybrid, electric, and fuel cell vehicle technologies. Toyota’s hybrid systems—as seen in the Prius—and Nissan’s electric vehicle technologies, such as those used in the LEAF, have achieved significant global success.

In addition, Japanese manufacturers have heavily invested in the development of autonomous driving and intelligent connected vehicle technologies, aiming to maintain a competitive edge in the future mobility landscape.

| Year | Company | Name of Overseas Subsidiary | Investment Type | Target Country |

| 1986 | Nissan | Nissan Motor Manufacturing (UK) Ltd. | Wholly Owned | UK |

| 1986 | Honda | Honda of Canada Manufacturing Ltd. | Wholly Owned | Canada |

| 1988 | Toyota | Toyota Motor Manufacturing Canada Inc. | Wholly Owned | Canada |

| 1989 | Suzuki | CAMI Automotive Inc. | Joint Venture (with GM) | Canada |

| 1990 | Honda | Honda Cars Philippines Inc. | Wholly Owned | Philippines |

| 1992 | Honda | Guangzhou Honda Motorcycle Co., Ltd. | Joint Venture (with Wuyang) | China |

| 1992 | Honda | Honda Automobile (Thailand) Co., Ltd. | Wholly Owned | Thailand |

| 1992 | Toyota | Toyota Motor Manufacturing (UK) Ltd. | Wholly Owned | UK |

| 1993 | Honda | Guangzhou Honda Automobile Co., Ltd. | Joint Venture (with Guangzhou Auto Industry) | China |

| 1993 | Nissan | Zhengzhou Nissan Automobile Co., Ltd. | Joint Venture (with Zhengzhou Light Auto) | China |

| 1996 | Honda | Honda Vietnam Co., Ltd. | Joint Venture | Vietnam |

| 1998 | Toyota | Tianjin FAW Toyota Motor Co., Ltd. | Joint Venture (with Tianjin Automotive Pipe Factory) | China |

| 1998 | Honda | Dongfeng Honda Engine Co., Ltd. | Joint Venture (with Dongfeng Group) | China |

| 1999 | Toyota | Toyota Kirloskar Motor Pvt. Ltd. | Joint Venture (with Kirloskar Group) | India |

Global Integration of Japan’s Automotive Industry

As globalization deepens, Japan’s automotive industry has established an extensive global supply chain network. Automotive parts production and sourcing now span across the globe, with Japanese manufacturers collaborating closely with international suppliers to ensure production efficiency and flexibility. For instance, Toyota’s renowned lean production model has been implemented not only in Japan but also across its global manufacturing facilities.

This model emphasizes minimal inventory, rapid responsiveness, and high-efficiency production, significantly enhancing overall competitiveness. However, globalization brings not only opportunities but also challenges. In recent years, escalating geopolitical tensions and trade disputes have impacted Japan’s global operations. Events such as the U.S.-China trade war and Brexit have increased uncertainty and risk in automotive exports.

To navigate these challenges, Japanese automakers must remain agile in the global market. By diversifying market presence and product strategies, they can reduce over-reliance on any single region and mitigate associated risks.

| Recipient | Accounts Receivable | Time | Description |

| Ford | Mazda | 1971 | Ford began collaborating with Mazda, acquiring a 7% stake in the company. |

| November 1979 | Ford increased its financial stake from 7% to 24.5%. | ||

| May 1995 | Mazda's financial difficulties in the 1990s (partly due to losses related to the 1997 Asian financial crisis) led Ford to raise its stake to 33.4%. | ||

| November 2008 | Ford announced the sale of a 20% stake in Mazda, relinquishing control of the company. | ||

| November 2010 | Ford further reduced its stake to 3%, citing that the reduction in ownership would provide greater flexibility to pursue growth in emerging markets. | ||

| Chrysler | Mitsubishi | September 1971 | Mitsubishi Heavy Industries formed a joint venture, holding an 85% stake, while Chrysler contributed 15%. |

| March 2000 | DaimlerChrysler AG and Mitsubishi signed a letter of intent to establish a global company. | ||

| November 2005 | DaimlerChrysler sold its remaining 12.4% stake in Mitsubishi Motors to investment bank Goldman Sachs, increasing its 2005 profits by approximately €500 million. | ||

| Renault | Nissan | March 1999 | Renault purchased 36.8% of Nissan's outstanding shares for $3.5 billion, rescuing the financially troubled company from the brink of bankruptcy. |

| March 1999 | Renault invested $1.6 billion to acquire an additional 2.5% stake in Nissan. | ||

| General Motors | Suzuki | August 1981 | General Motors acquired a 5.3% stake in Suzuki. |

| September 1998 | Suzuki and General Motors agreed to jointly develop compact cars, strengthening business collaboration and forming a strategic alliance. GM adjusted its stake in Suzuki from 3.3% to 10%. | ||

| January 2001 | General Motors Group acquired a 20.1% stake in Suzuki Motor Corporation. | ||

| March 2006 | GM announced in Tokyo the sale of a 17.4% stake in Suzuki. GM stated that the transaction was valued at approximately $2 billion. After the sale, GM retained a 3% stake in Suzuki's issued shares. | ||

| Isuzu | September 1971 | General Motors acquired a 34% stake in Isuzu. | |

| December 1998 | GM purchased ¥52.5 billion ($457 million) worth of new shares in Japanese truck manufacturer Isuzu Motors, increasing its stake from 37.5% to 49%. | ||

| April 2006 | GM sold its entire 7.9% stake in Isuzu but stated that collaboration would continue. | ||

| Subaru (Fuji Heavy Industries) | October 2005 | GM sold its 20% stake in Fuji Heavy Industries, ending the alliance between the two companies. GM stated it would refocus its efforts and resources on high-growth markets in the Asia-Pacific region. |

Adapting to Global Environmental Regulations and Seizing Emerging Market Opportunities

Increasingly stringent environmental regulations across the globe are placing greater demands on the automotive industry. Automakers must accelerate the transition to new energy vehicles (NEVs) to meet diverse environmental standards. For instance, the European Union’s emission regulations impose strict limits on traditional fuel vehicles, while China is aggressively promoting electric vehicle (EV) adoption.

To meet these challenges, Japanese automakers must not only continue to innovate technologically but also adapt their market strategies to the evolving policies and demands of different regions. The Japanese automotive industry needs to further strengthen its innovation capacity—particularly in the fields of electrification, intelligent connectivity, and autonomous driving. These three areas are widely regarded as the future pillars of automotive development.

Significant investment is required in battery technology, autonomous driving systems, and vehicle-to-everything (V2X) connectivity to enhance product competitiveness and value. Collaborating with international technology firms will be essential to accelerating innovation. Global partnerships will be key to achieving sustainable development in Japan’s automotive sector.

By establishing closer ties with overseas partners, Japanese automakers can better respond to shifts in the global market. Collaboration with Western manufacturers in R&D and marketing, and with emerging economies in production and supply chains, will help strengthen Japan’s global competitiveness. Emerging markets, in particular, offer tremendous growth potential.

As economies in Asia, Africa, and Latin America continue to expand, demand for vehicles will rise steadily. Japanese automakers must proactively explore these regions, offering products that are cost-effective and tailored to local needs. Markets such as India, Southeast Asia, and Africa are expected to become key strategic regions for Japanese automotive brands in the coming years.

Conclusion

Over decades of development, Japan’s automotive industry has evolved from an export-driven model to one of deep global integration. In response to increasingly complex global market dynamics and rising challenges, Japanese automakers have continuously innovated, adapted their strategies, strengthened international collaboration, and expanded into emerging markets—all in pursuit of sustained competitiveness and long-term growth.

Contact Us